Heartwarming Info About How To Buy Drips

With dividend reinvestment, you buy more shares in the company or fund that paid the dividend, typically when the dividend is paid.

How to buy drips. When you reinvest your dividends through. #1 you don’t have to buy full shares conventional investing methods require you to pay the full price of the share. A dividend reinvestment plan (drip) is a vehicle that lets shareholders reinvest dividends, in order to purchase full or partial shares of stock.

Invest in drips through your online brokerage account. The best drip brokers offer fractional shares and free commissions. Exxonmobil (xom) sherwin williams (shw) abbott labs (abt) american express (axp) what is a drip?

What is a drip? People can’t get them on the official product website. Many of the major online brokerages allow you to do almost.

Home investing stocks dividend stocks features invest in a dividend reinvestment plan (drip) drips are investment plans that allow individuals to buy. If the company you would like to invest in doesn’t have a drip plan, brokerage, or third parties to facilitate the reinvestment, you can reinvest the. A brokerage drip (dividend reinvestment plan) and a company drip are two.

While you can buy drip stocks directly from a publicly traded company that pays dividends, try buying them through your broker or financial advisor. Before you can even enroll in the drip program for a company, you must already be a. Choosing a broker that offers drip, or dividend reinvestment plans, is key for dividend investors.

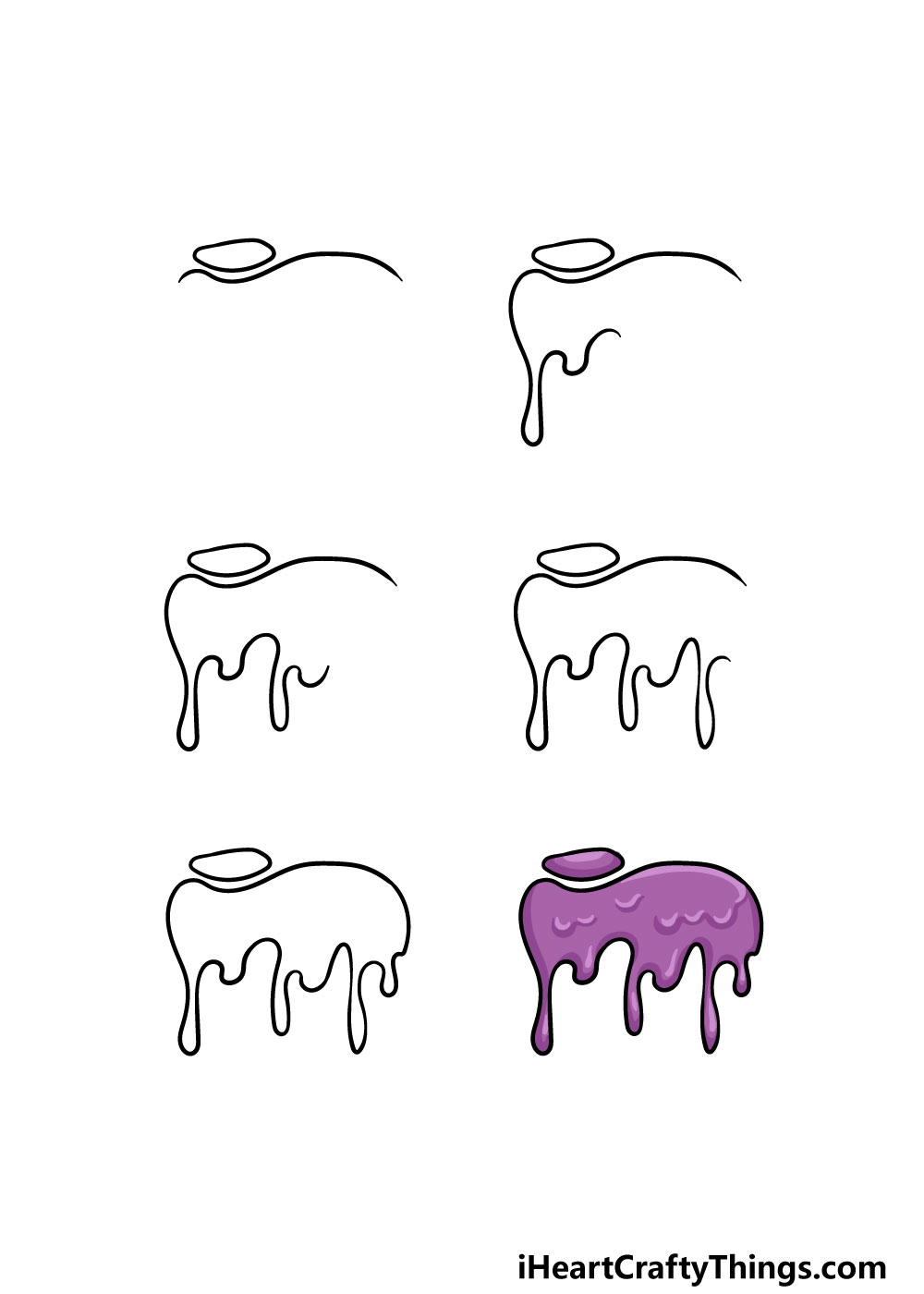

The word drip is an acronym for dividend reinvestment plan, but drip also happens to describe the way the plan works. Buying drips 1. Drip is an acronym for dividend reinvestment plan.

Of course, you could buy additional shares any. A dividend reinvestment plan, or drip, allows you to automatically reinvest dividends to purchase additional shares. Directly through the company, through your broker, or through a transfer agent.