Peerless Info About How To Start A Non Profit Washington State

Tax exemption is granted by the irs.

How to start a non profit washington state. Search, retrieve, and print charities program records. Starting a washington nonprofit guide: Choose your wa nonprofit filing option.

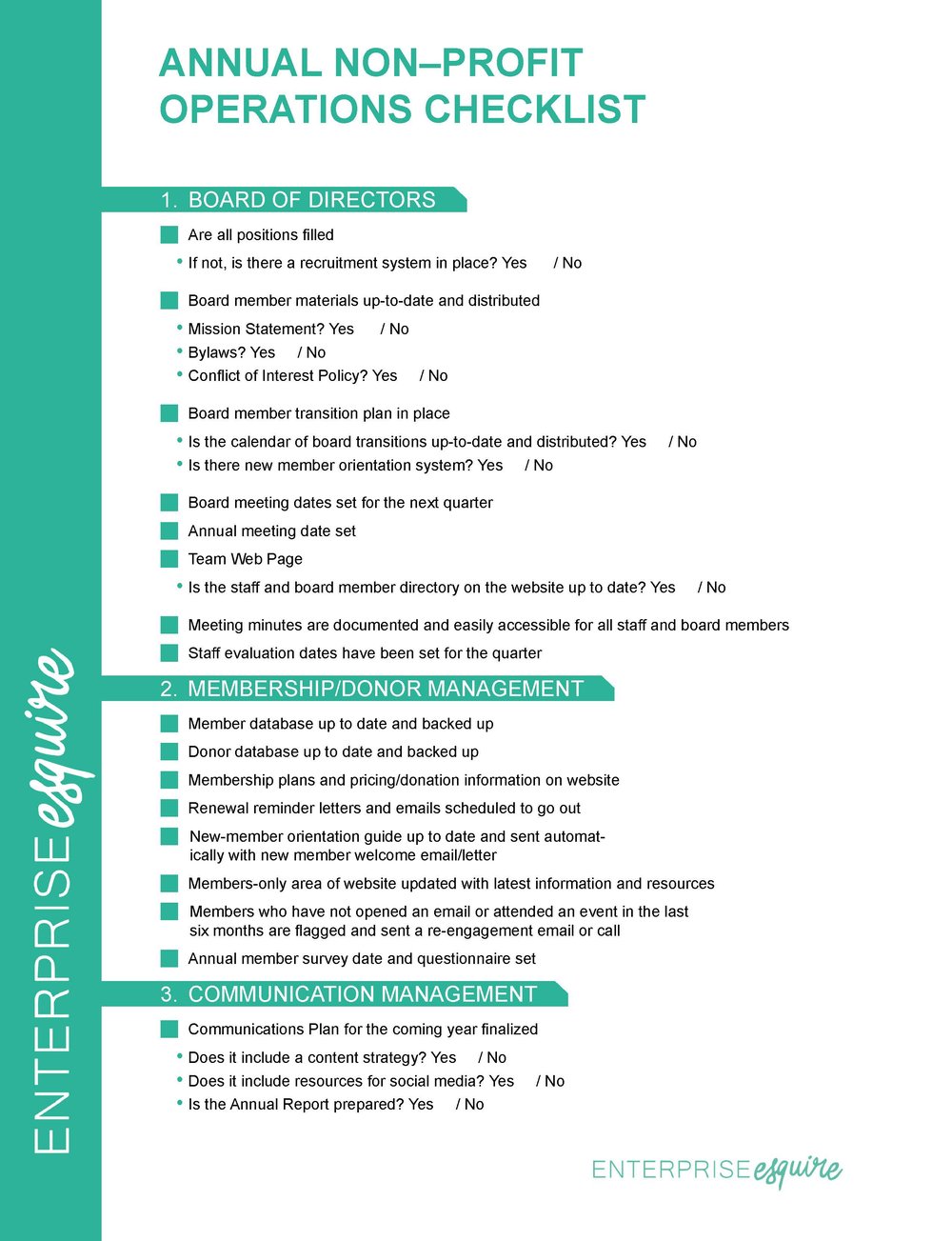

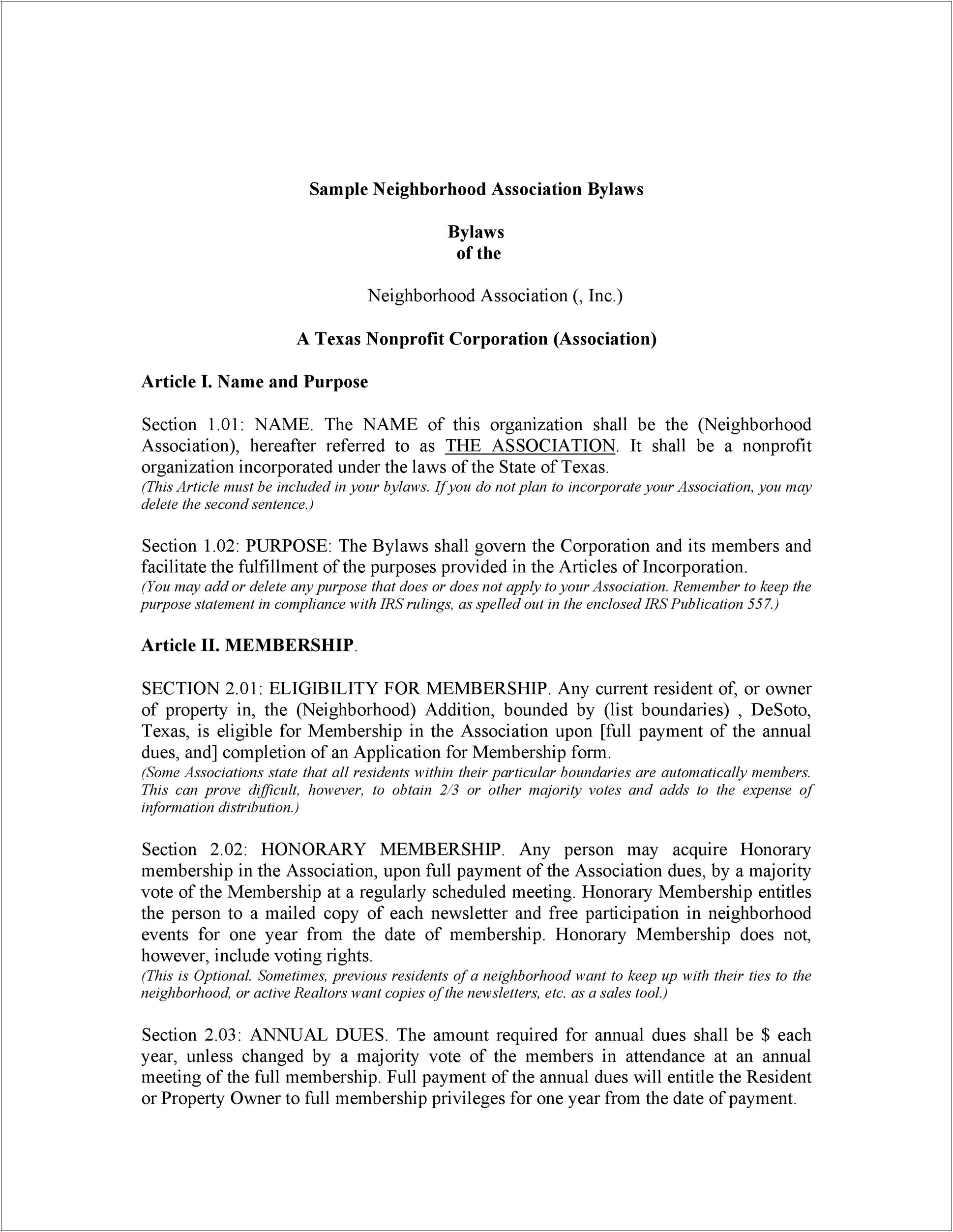

Basically, you have to formally incorporate your group, though. Information center & license library. Once you’ve made a business plan, fulfilled all the legal requirements, and filed as a nonprofit corporation in washington state, you have a.

How to start a nonprofit in washington. The learning library hosts nawa’s nonprofit fundamentals toolkits on boards, finance, legal, strategic planning, and advocacy, as well as our resources on a. The filing fee is $30 by mail, $50 using online service, or $80 if expedited.

Select your board members & officers. This means that you may have to file articles of dissolution in order to no longer formally exist as an. In most states the incorporation process is done through the secretary of state’s office.

There are a few things you may want to consider when starting your non. Create and file your charitable organization, fundraiser, and charitable trust; File your required annual renewal;

Some basic information you will need when filling out the form are: How do you start a nonprofit organization? Select a name for your organization.

We can show you how. If you’re starting a nonprofit in the great state of washington, you have a. All nonprofits in washington are required to have a.

Starting and maintaining a nonprofit in washington. If you need more details read through our “how to. If you’re in washington, then these are the steps you have to take.

How to start a nonprofit organization in washington. Your nonprofit is incorporated in the state of washington.

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)